Integer has advised and invested in a varied portfolio of property assets. Integer actively pursues investments with strong risk adjusted returns to its investors.

Residential Real Estate

Integer utilises its substantial expertise in advice, project delivery and finance to facilitate residential investment opportunities for the benefit of its investors. We have successfully advised, funded and structured a wide number of real estate development projects, with a level of oversight and compliance that represents industry best practice. Integer focuses its strategy on high-growth corridors with strong housing demand and access to new and existing major infrastructure, securing a significant portfolio of quality residential development opportunities in the Sydney metropolitan area. Integer continually looks for innovative approaches to unlock the potential for residential development projects in all market conditions.

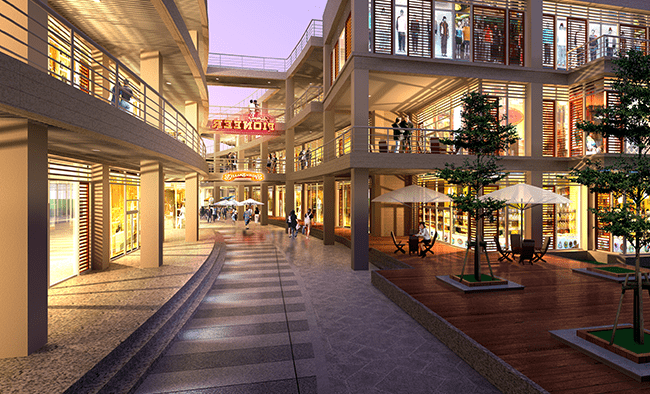

Retail

Integer has a strong record of successfully delivering specialty retail assets, including petrol filling stations and fast food retail offerings. With an established network of contacts in the field, Integer is always at the forefront of sourcing new and valuable investment opportunities. These asset types can provide counter-cyclical opportunities, depending on the prevailing market conditions.

Hospitality

Integer has entered the hospitality sector with strategically located acquisitions and the support of industry leaders. Our strong acquisition strategy has identified suitable assets for a portfolio of hotels and expansion into a fast growing market. By involving well-respected advisers and project partners, Integer is set to unlock further hospitality investment opportunities.

Retirement

The market for retirement living for older Australians is expected to double over the next two decades, driven by an ageing population, increased life expectancy and a preference for community living. Integer Securities is part of this fast-growing investment sector, acquiring key retirement living assets in metropolitan and regional markets that satisfy investment criteria.

Our strategy will deliver high quality, affordable housing and community lifestyle and leisure facilities to the growing number of retirees, and generate long term annuity streams for our investors.